Tax planning: Pre and post emigration

The Income Tax Act is structured in such a way as to ensure a considerable tax liability is triggered when South Africans break tax residence, for example on emigration. The tax consequences of monies in Retirement funds, local and offshore endowments, income streams and assets owned must all be considered and understood by individuals considering leaving South Africa or who have left SA without regularising their affairs with SARS.

Retirement Fund rules have been changed. Regularising a taxpayer’s residence status with SARS is essential. Taxpayers in employment outside SA need to consider their tax residence, effect of a DTA and the expat tax.

-

The outcomes of the live events has been mapped to the following competencies: Tax planning, Tax governance.

-

The live event is ideal for Continuing Professional Development and where required the necessary CPD accreditation is obtained from the professional body. For more information contact us.

-

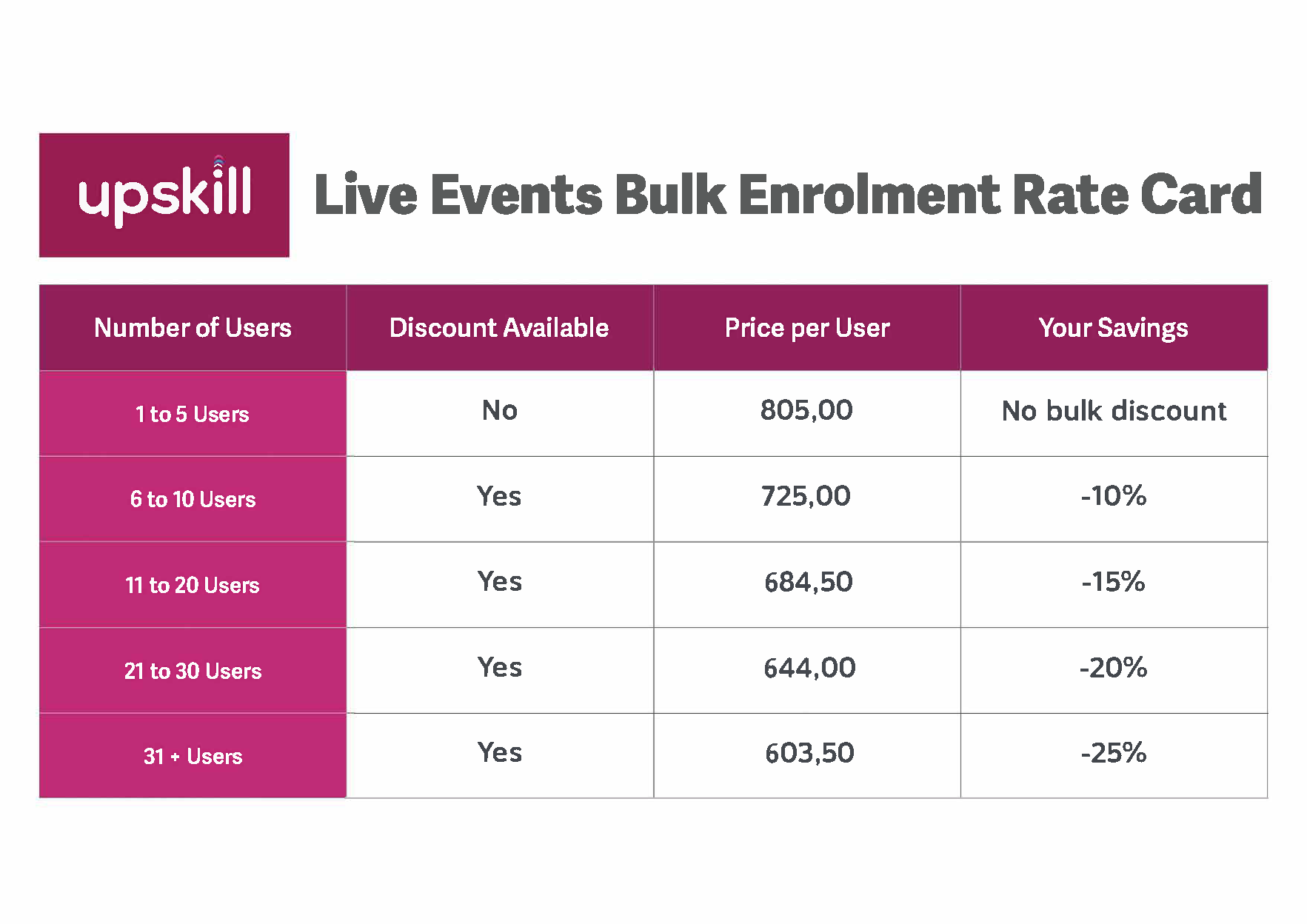

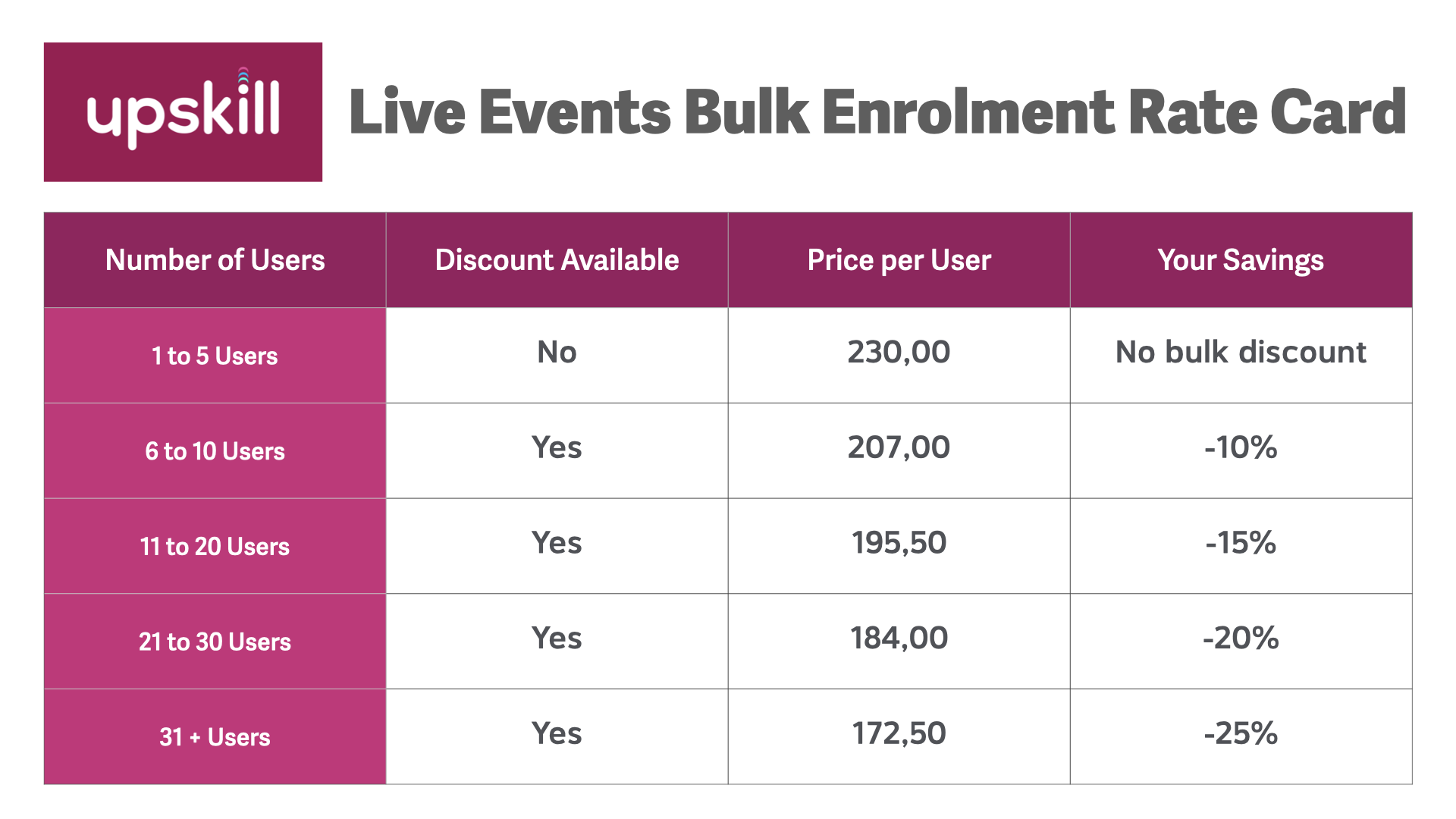

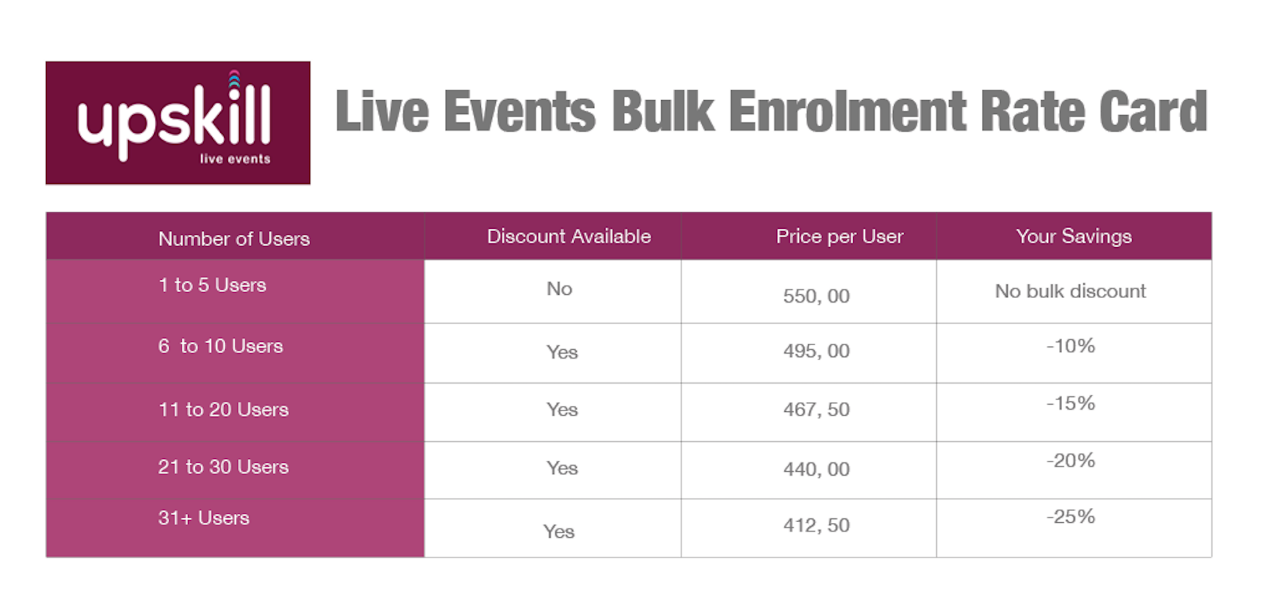

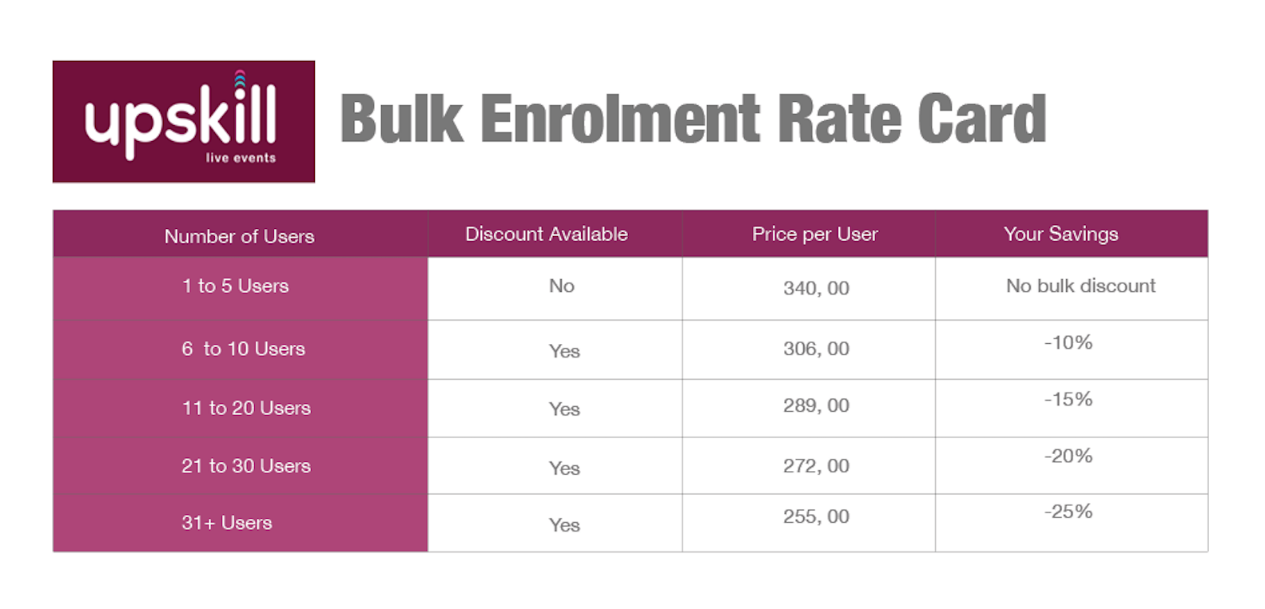

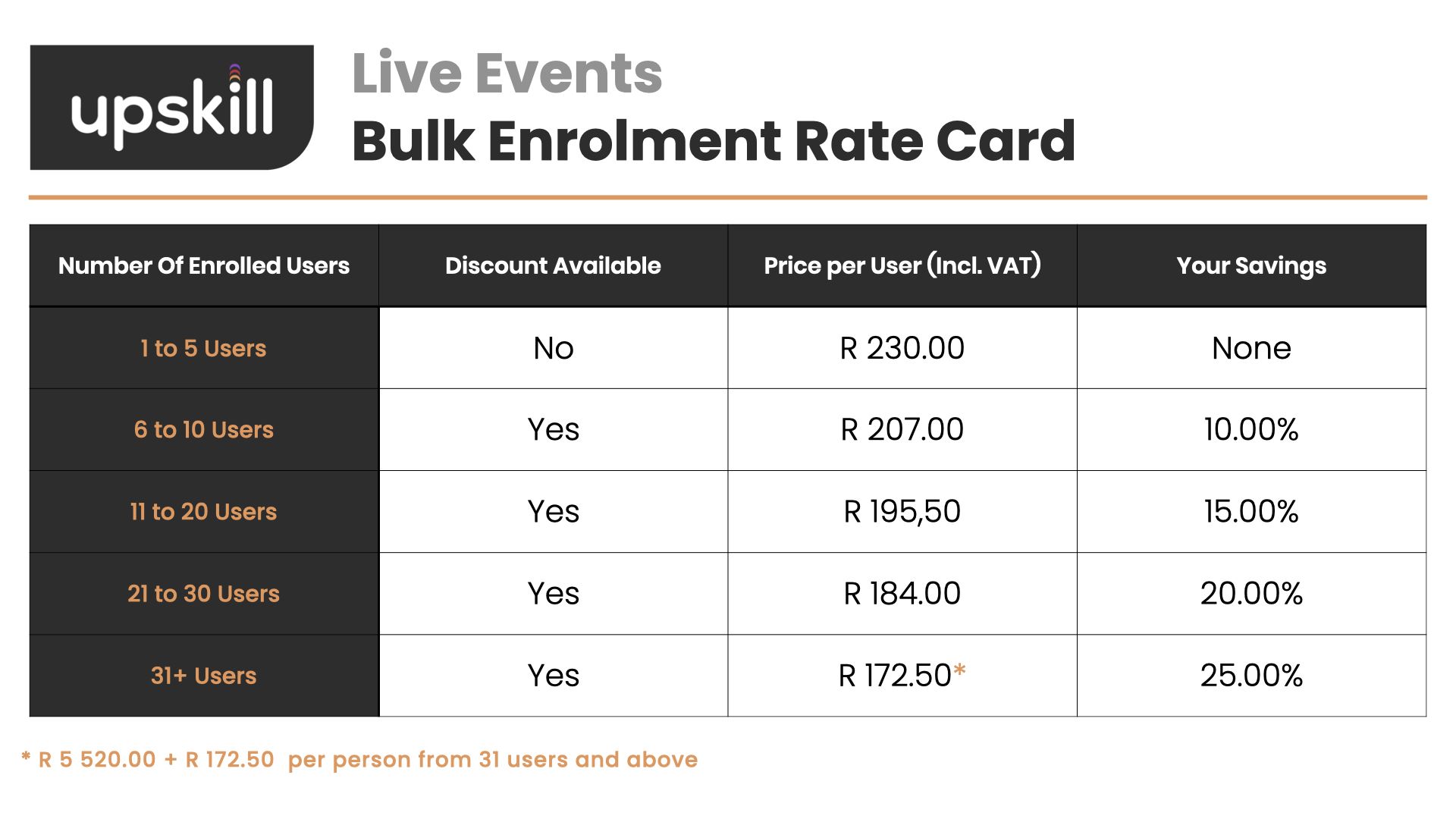

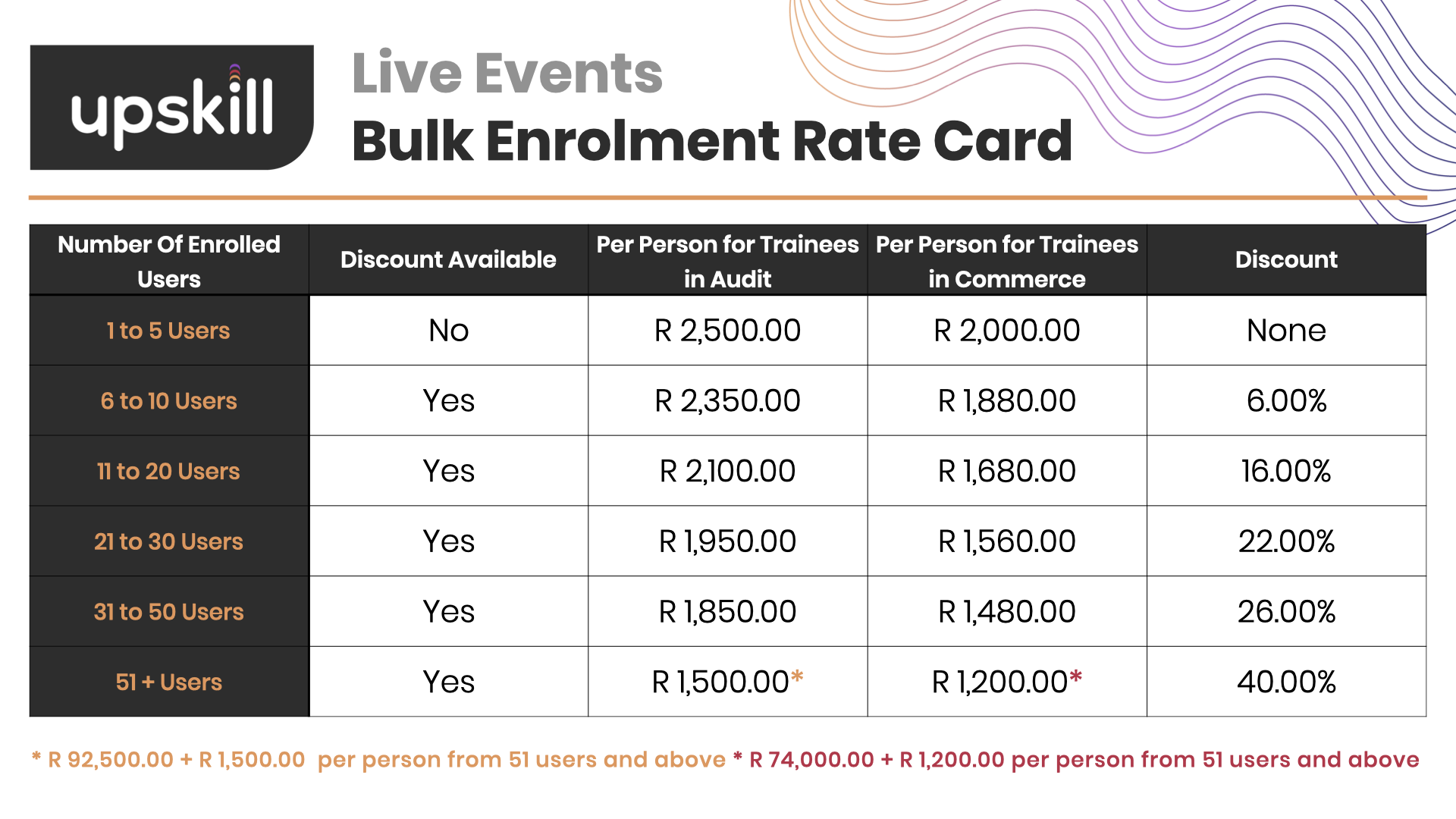

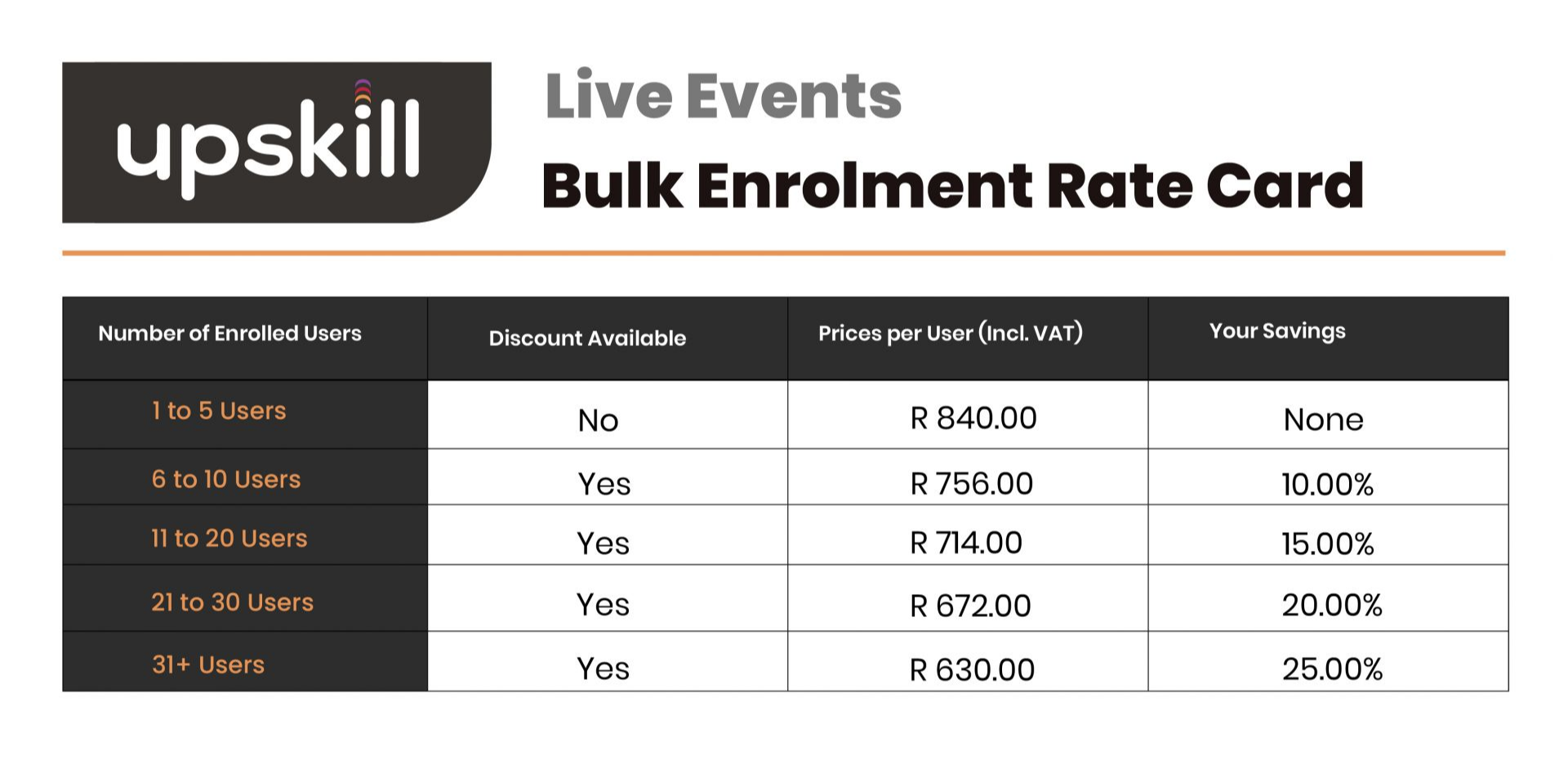

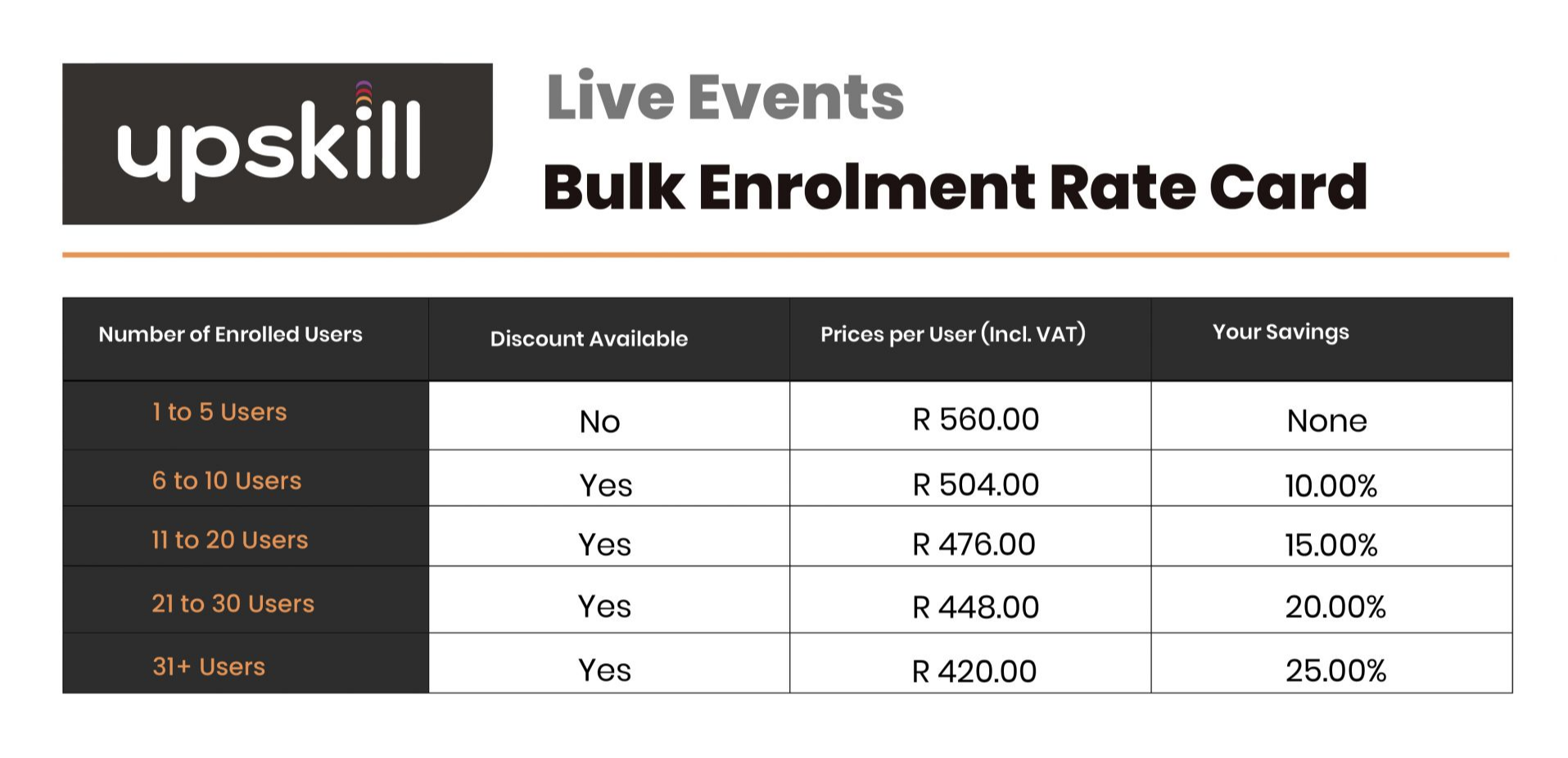

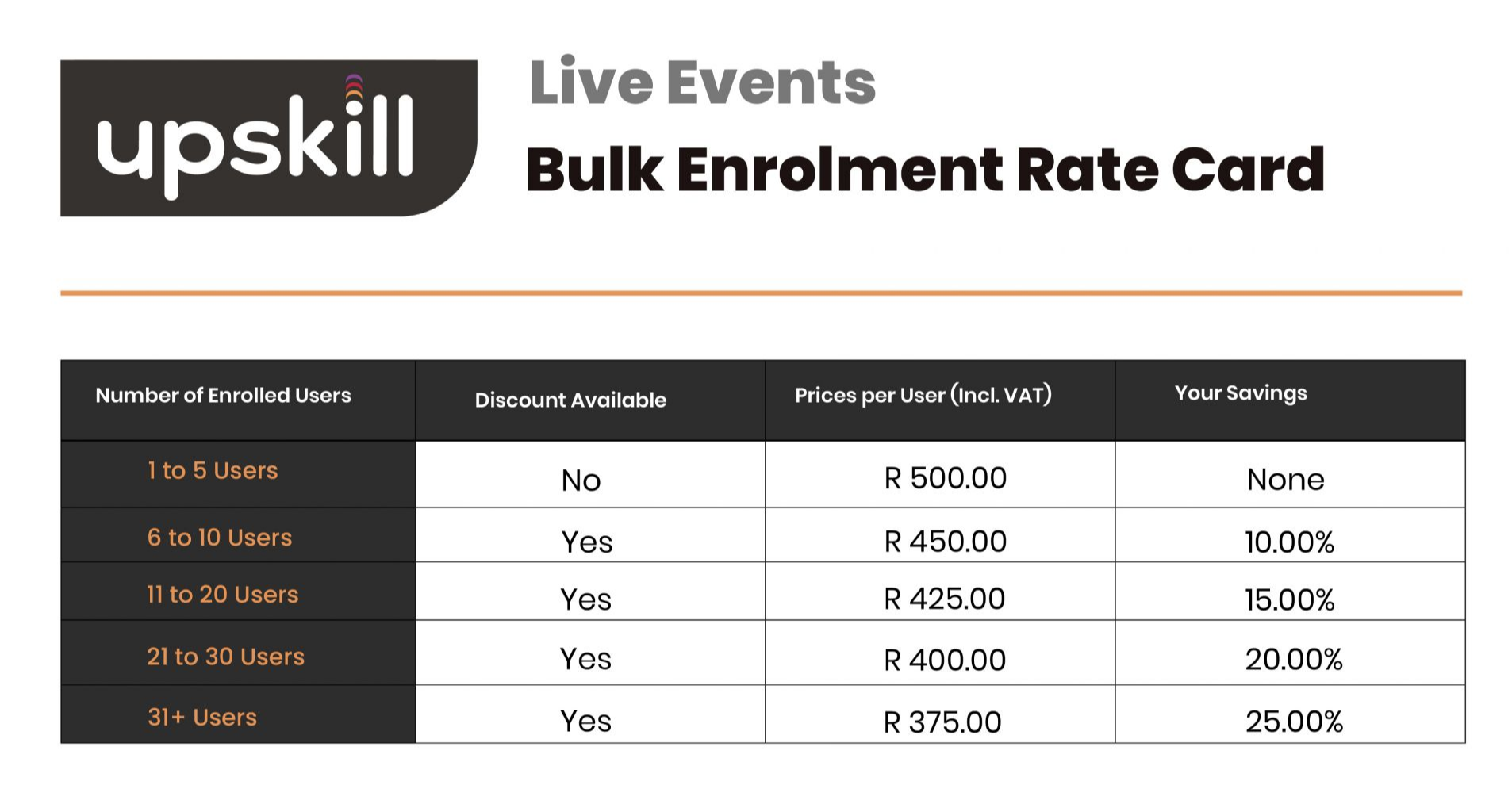

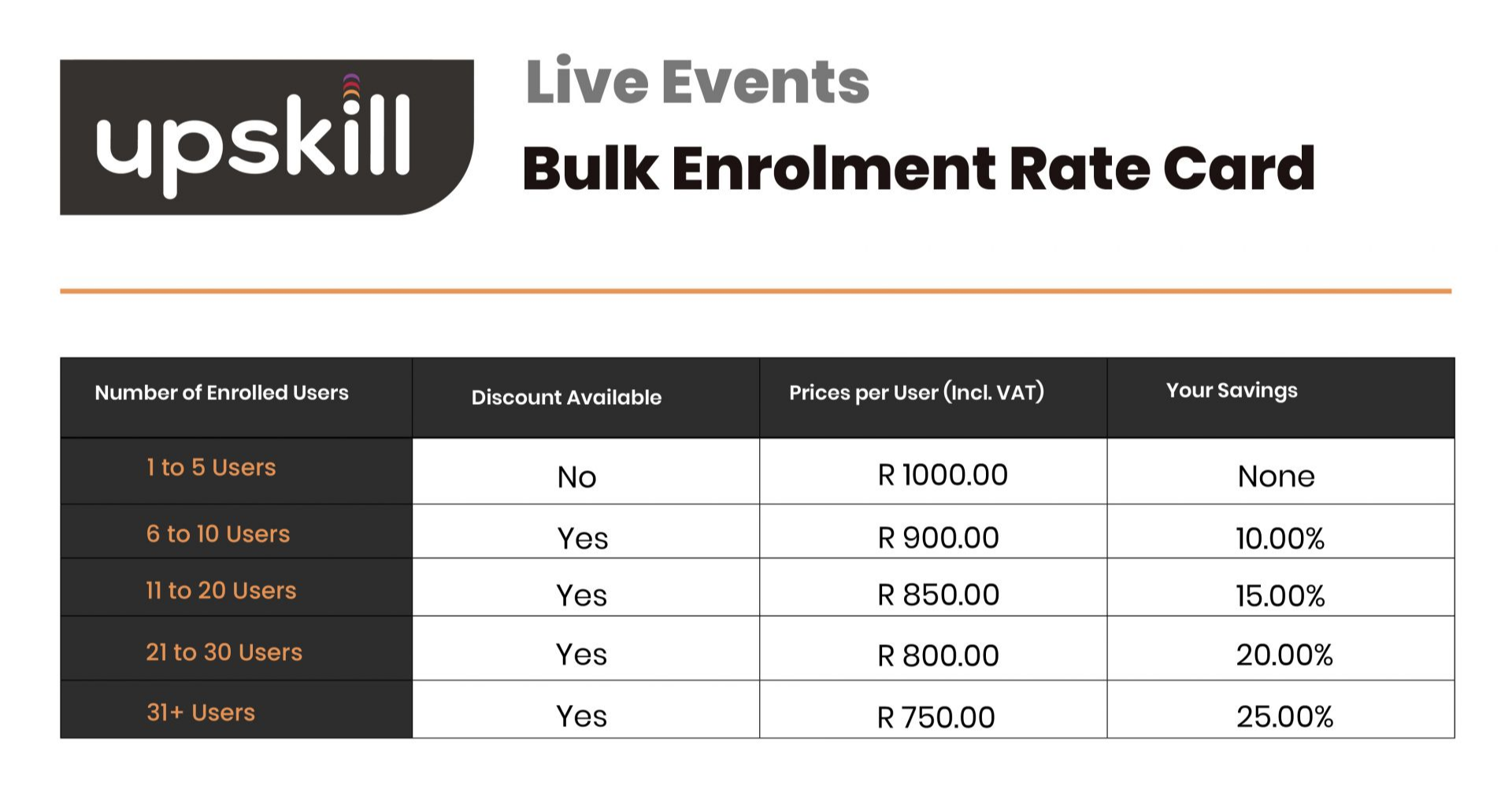

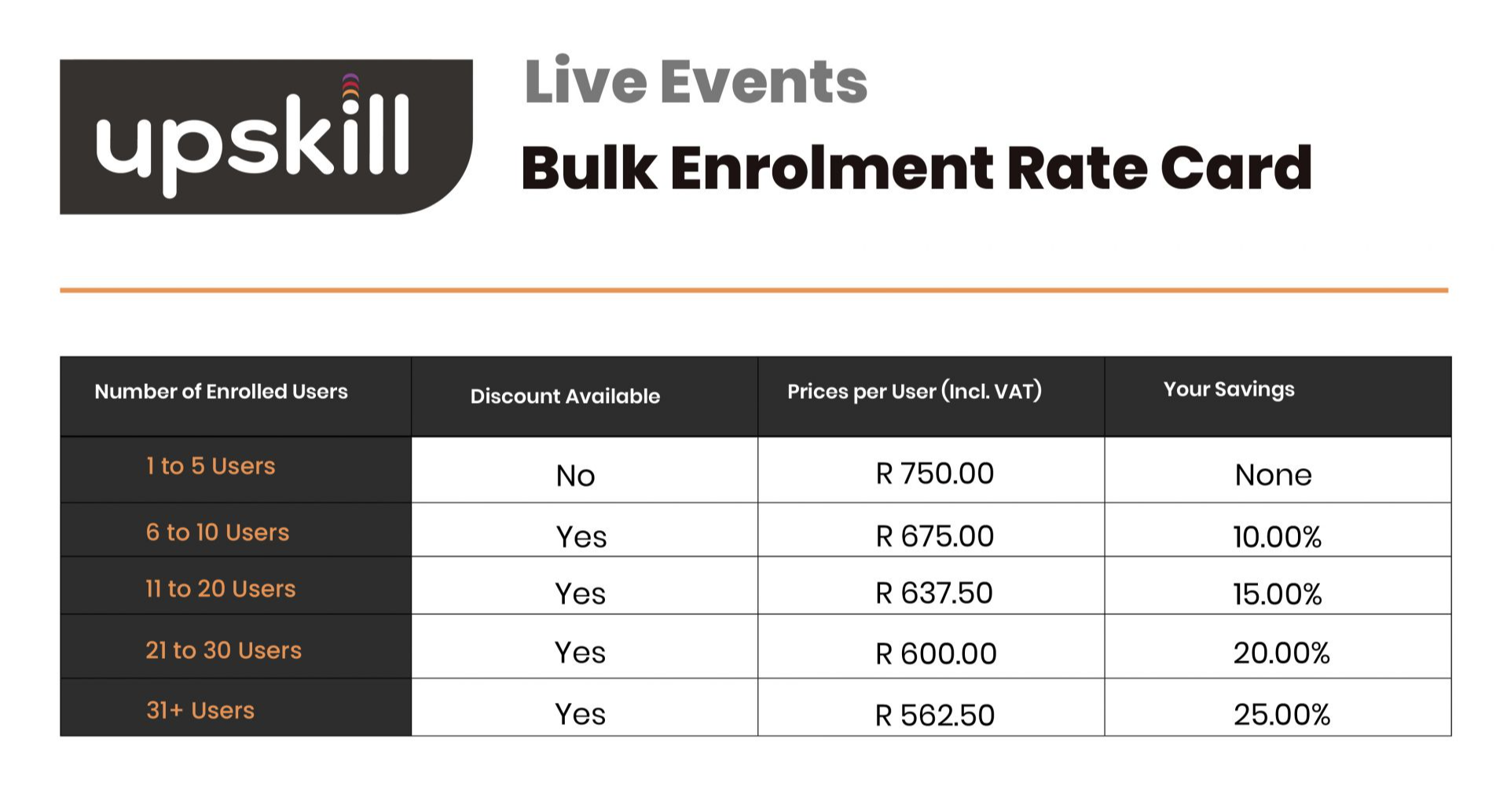

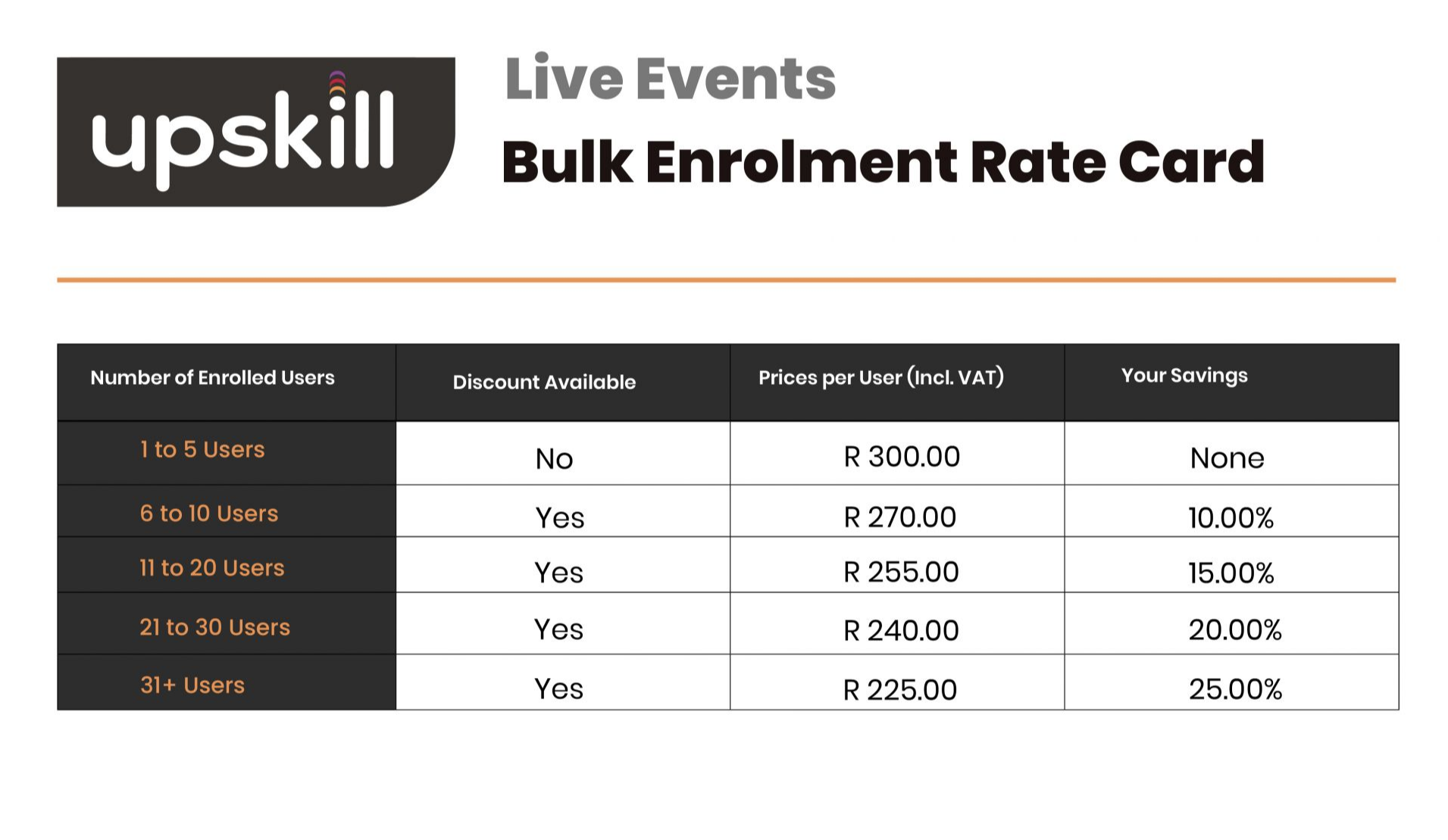

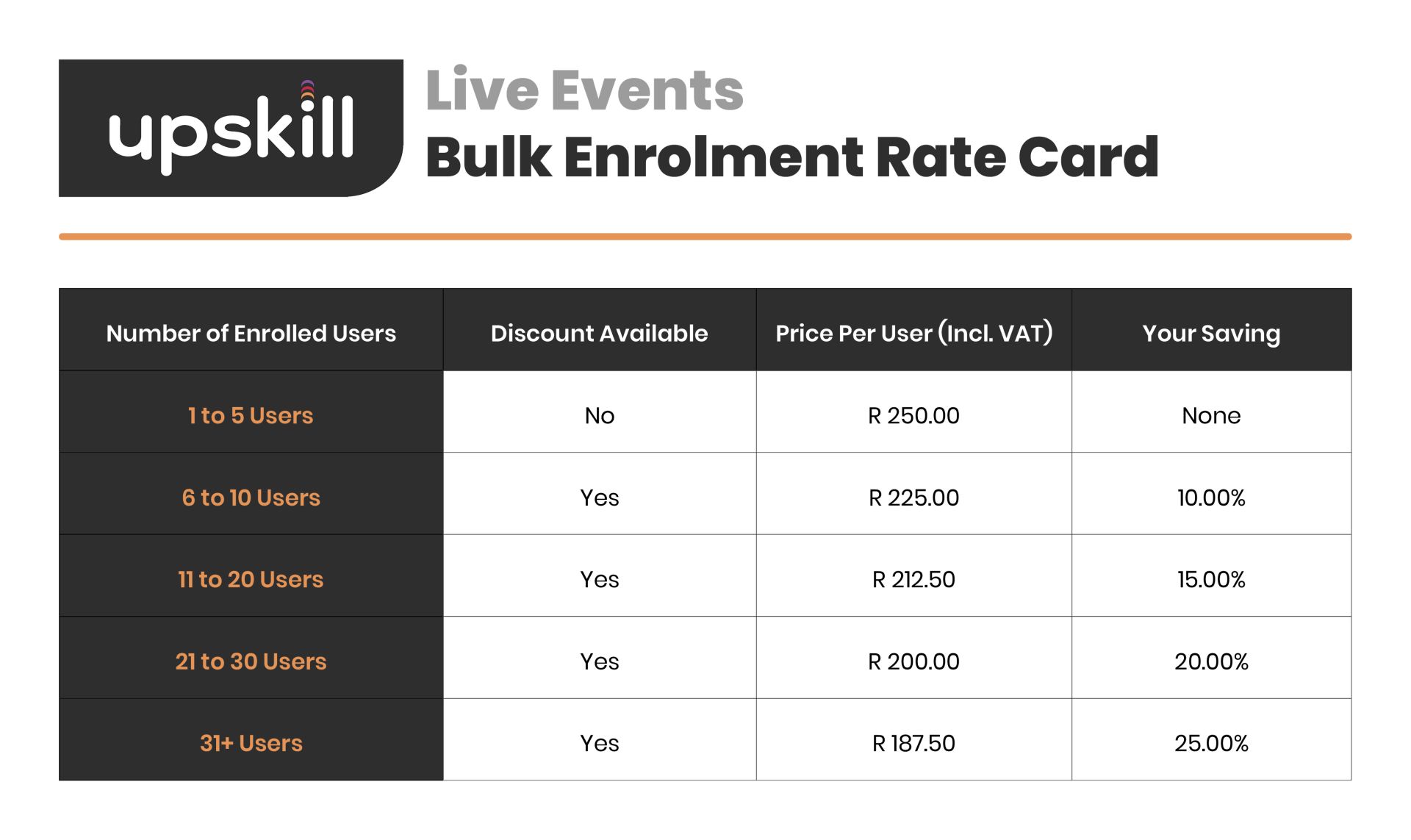

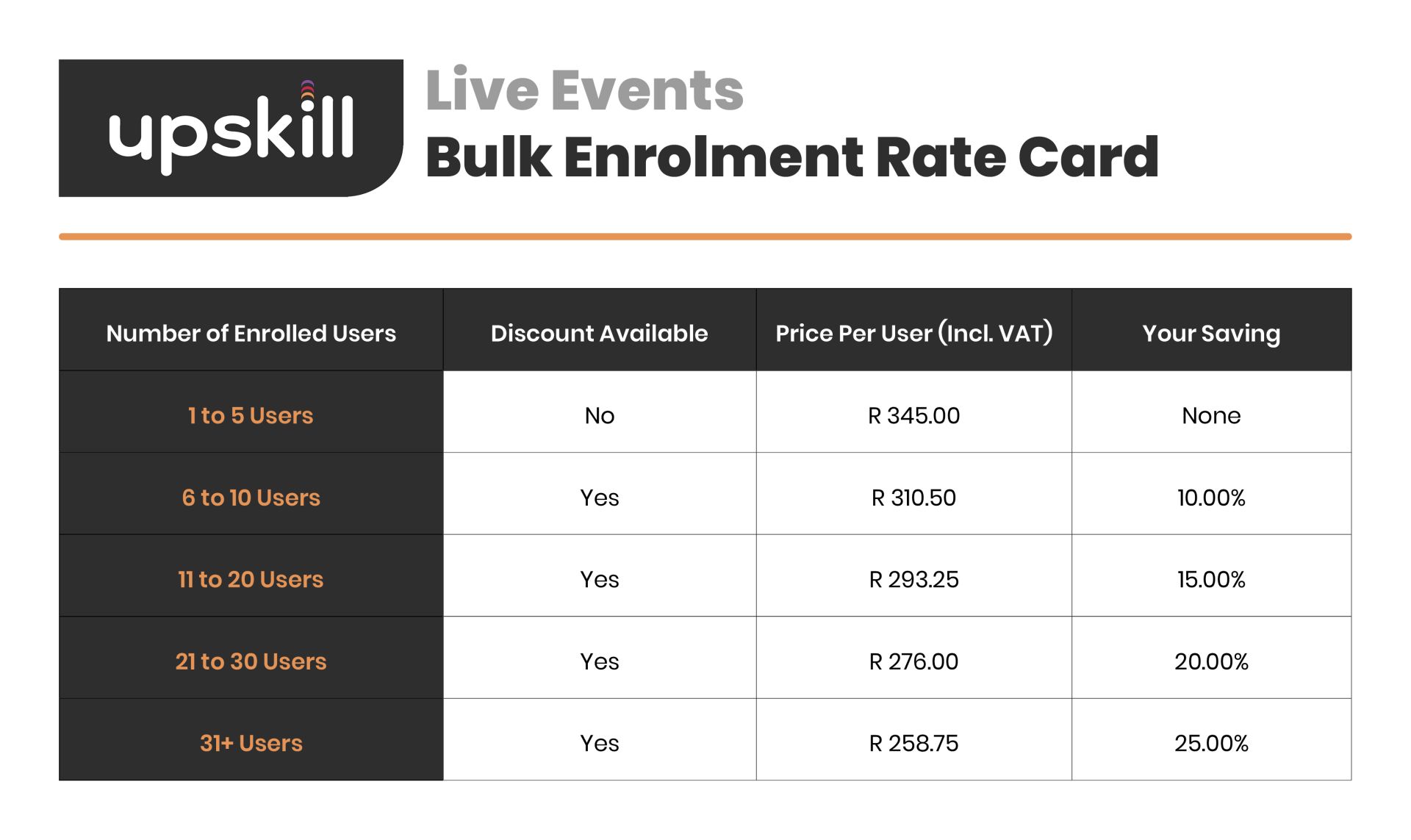

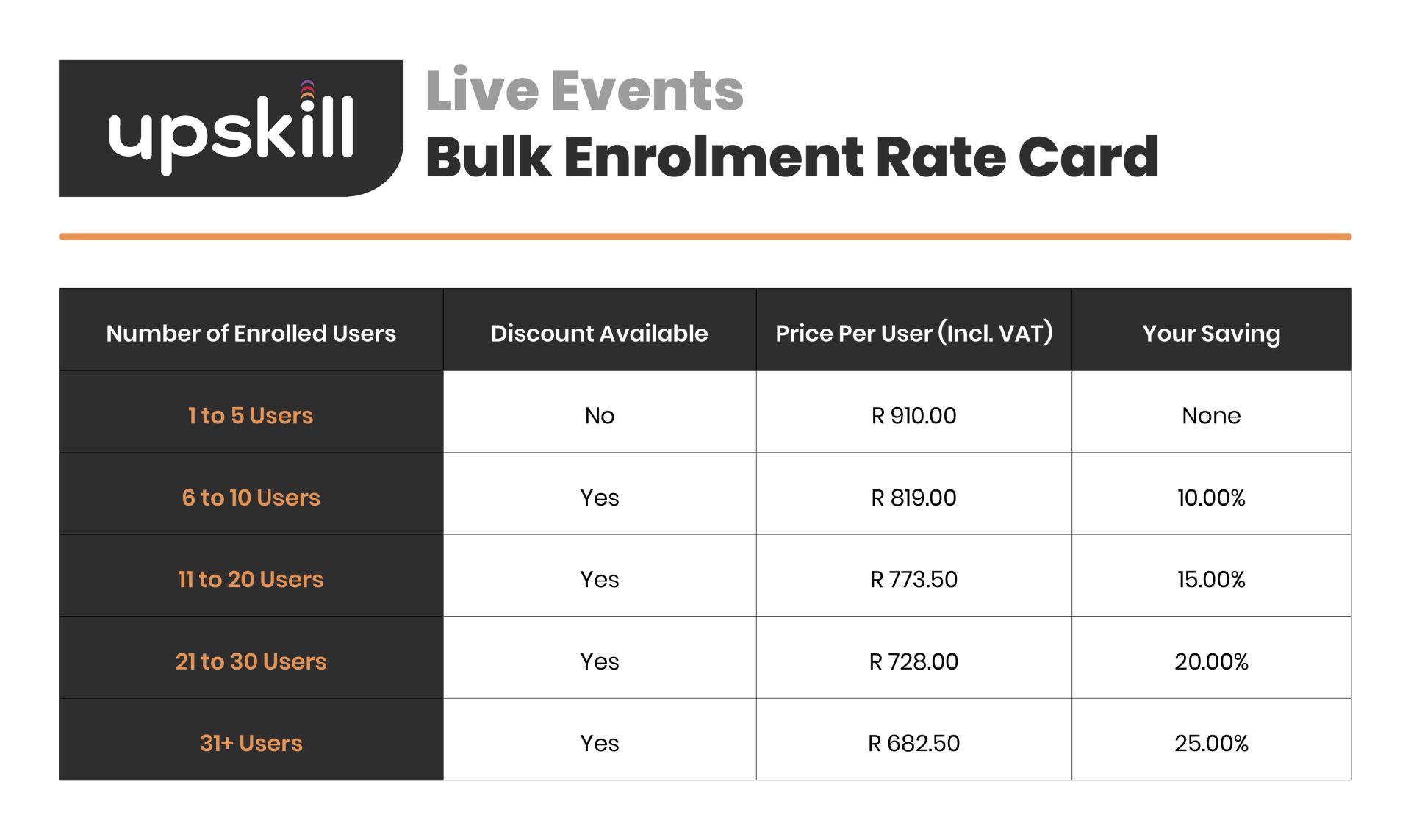

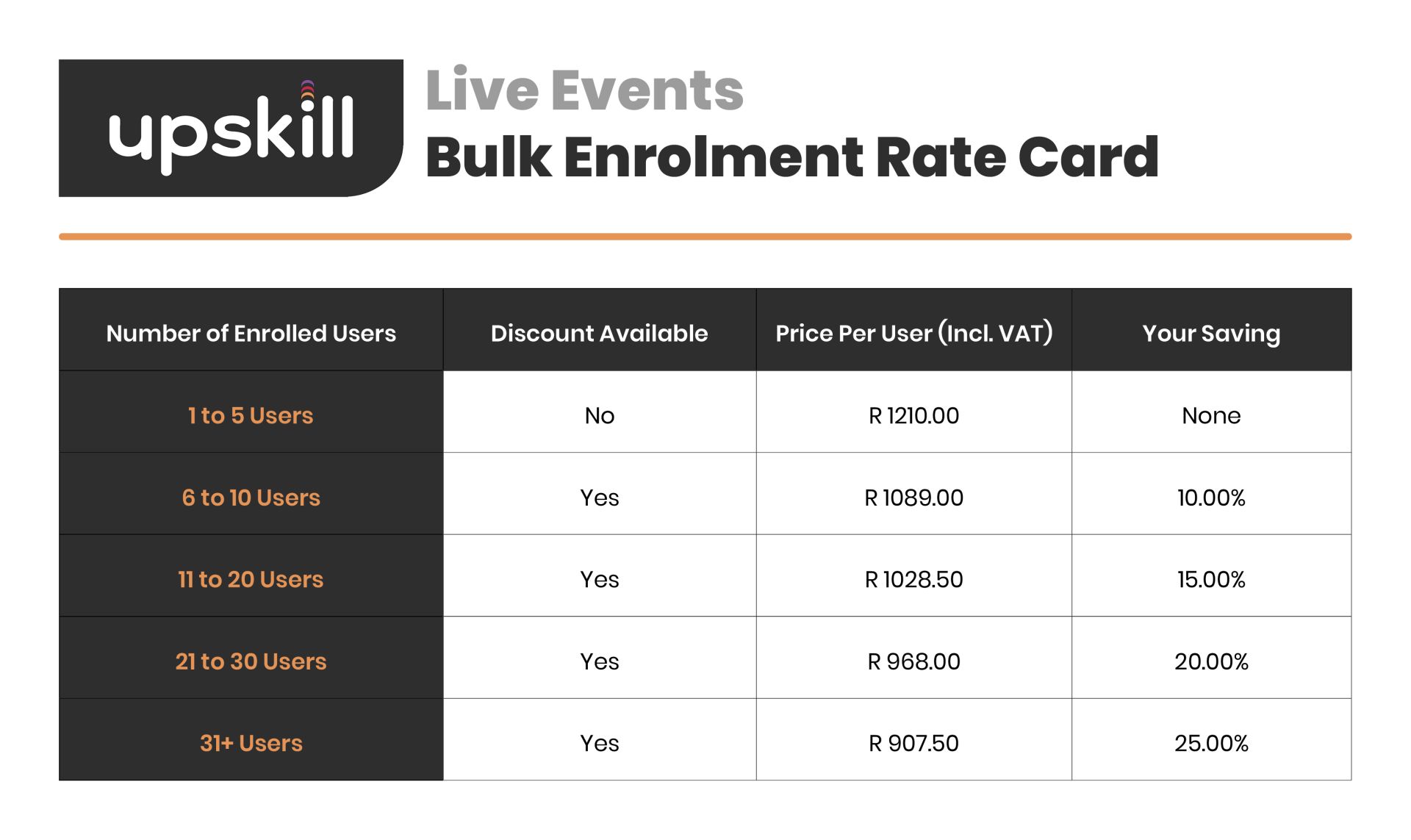

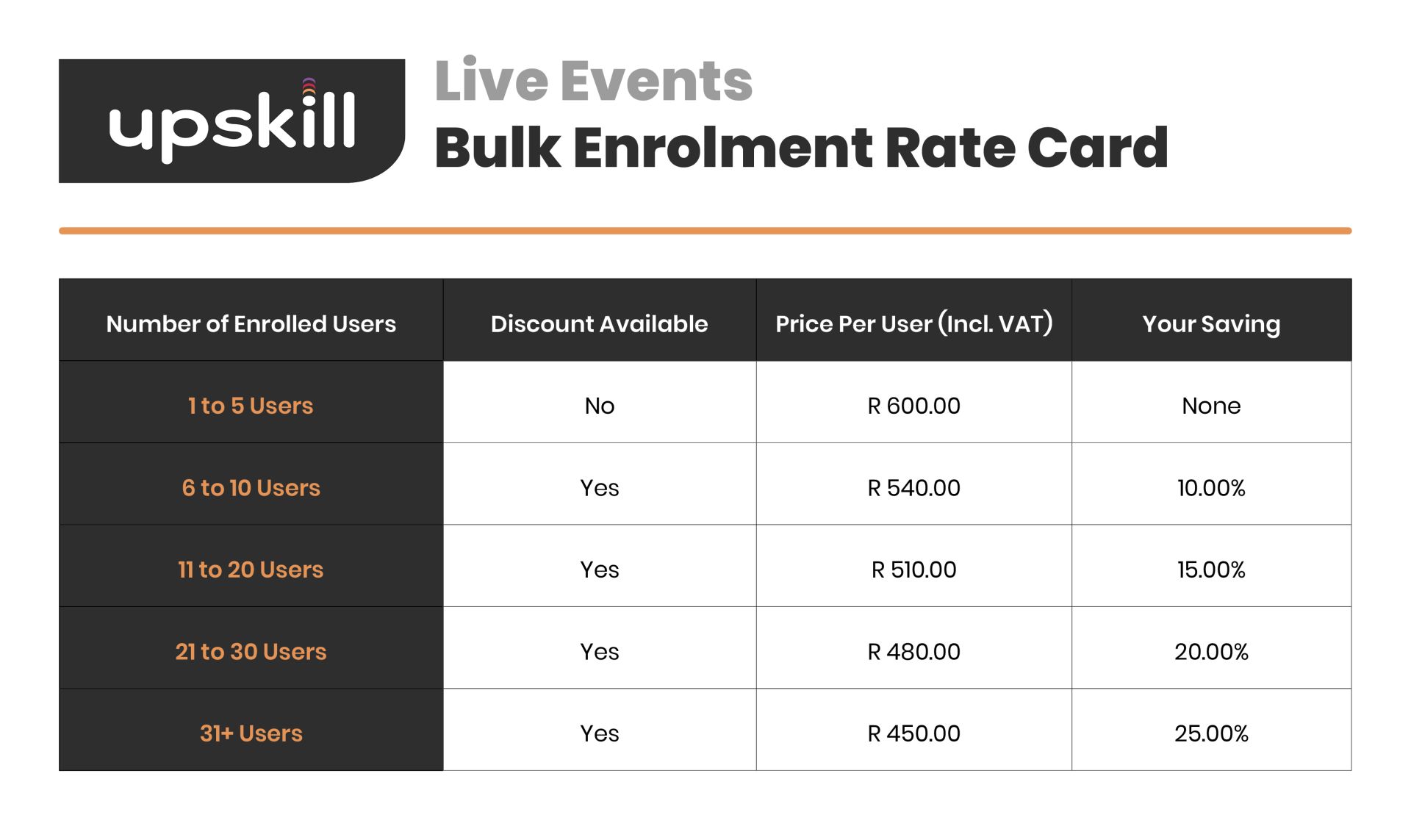

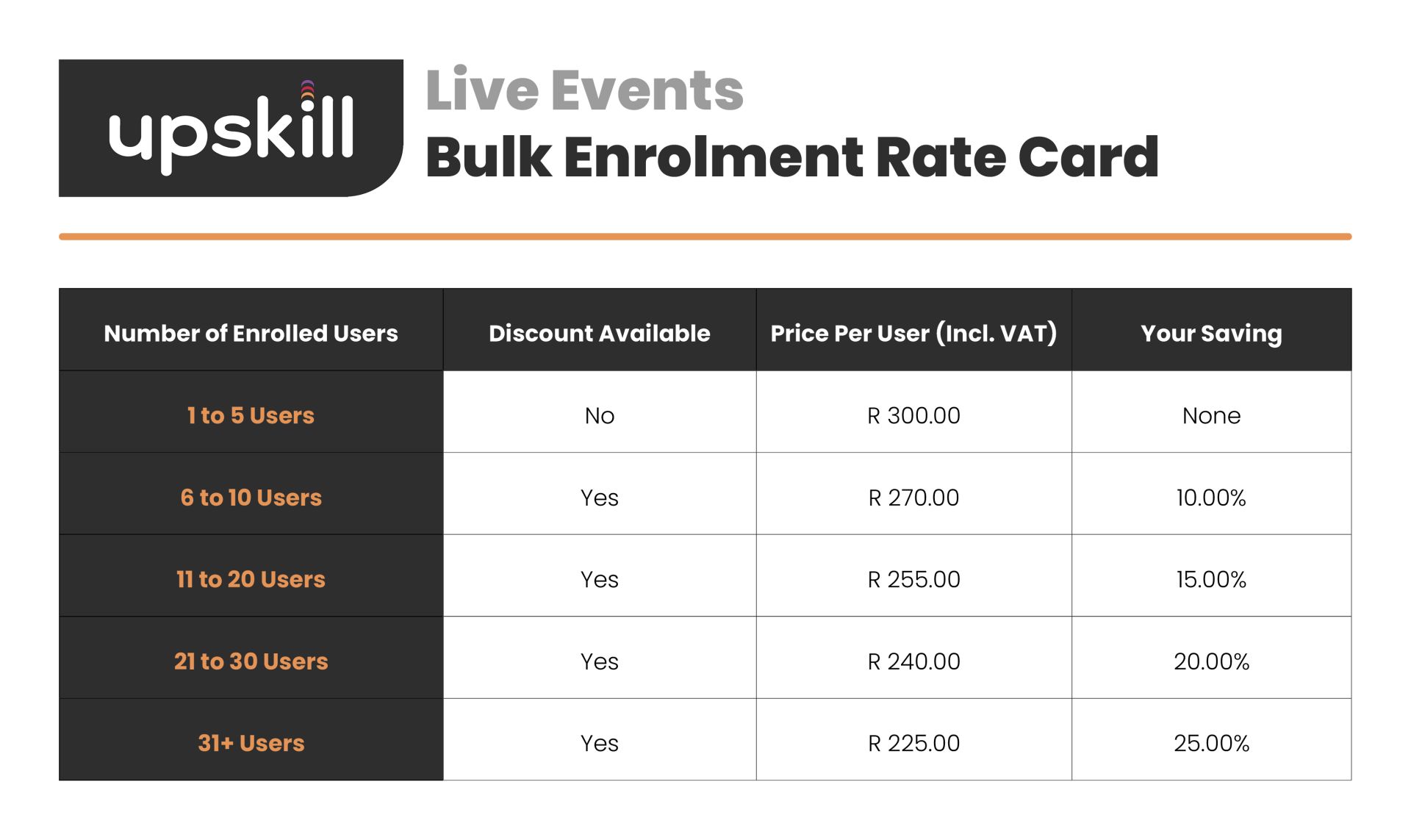

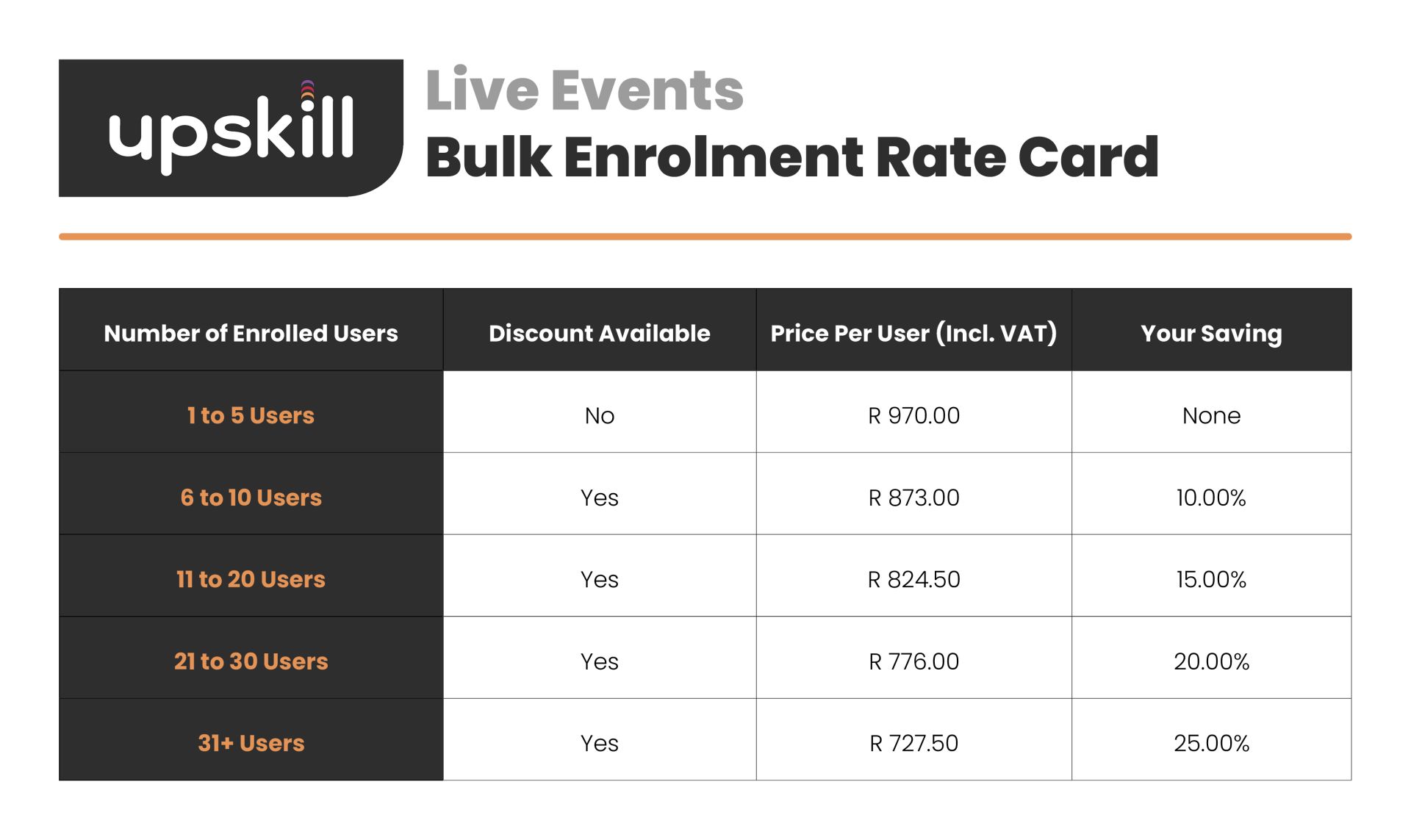

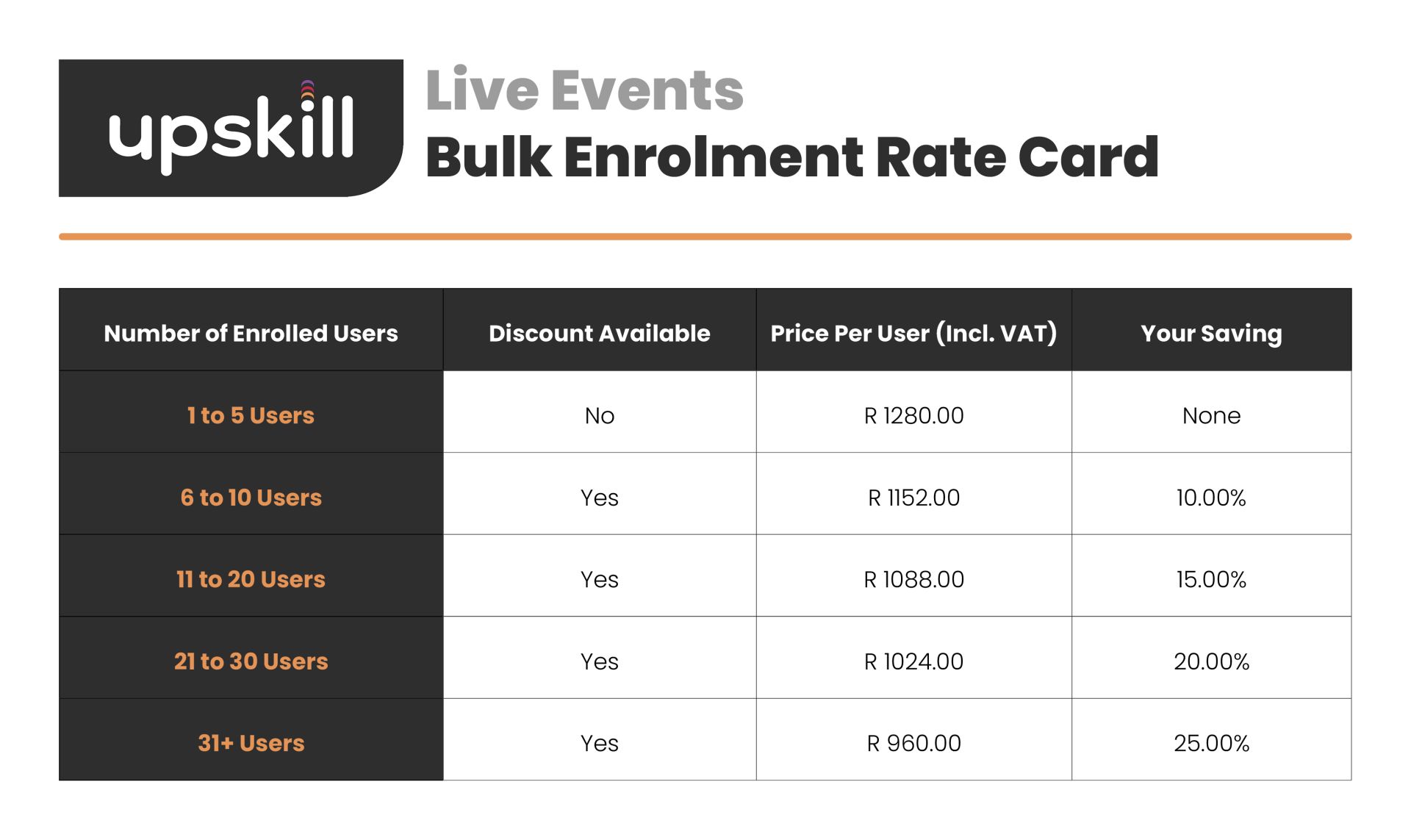

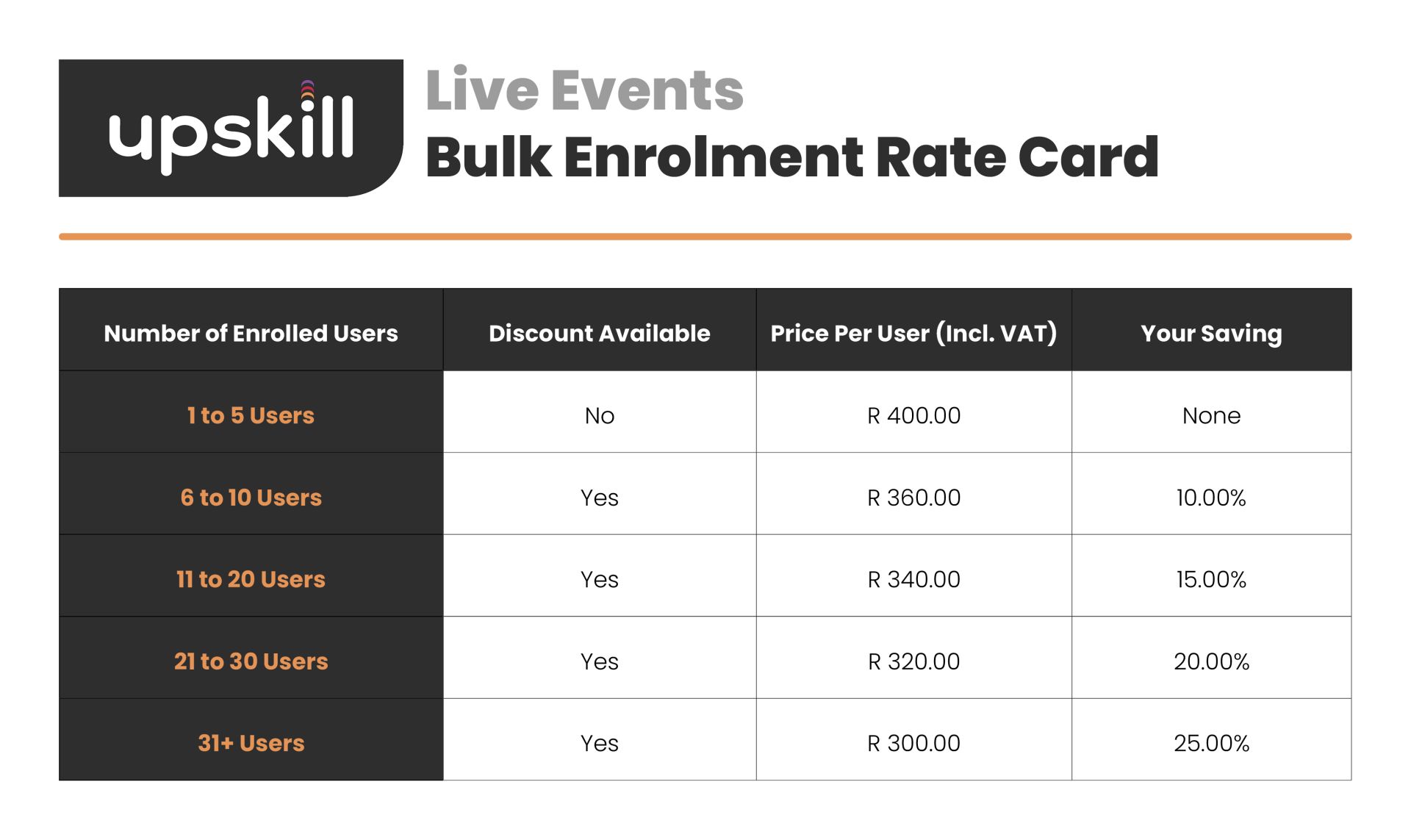

We offer bulk registration discounts for group bookings on our live events. Please view our standard group booking rate card here.

Write your awesome label here.

Event hosted by

Diane Seccombe

Ideal for

Continuing Professional Development (CPD)

Date

Part 1 - 12 September 2023

Part 2 - 19 September 2023

Part 2 - 19 September 2023

Time (SAST)

09h00-11h00

This live event is recorded

Topics addressed include:

New Tax clearance: Approval of International Transfer

Taxation of foreign remuneration

Effect of trading in SA after breaking tax residence

Breaking tax residence and use of a double taxation agreement (DTA)

- RAV01 form and Non-resident certificate

Assets and monies in SA

- Accessing monies in Retirement Funds and deduction Fund contributions

- Inheritances

SA Trusts

- New Rules for Non-resident SA trust beneficiaries

- Loans to trusts

CGT consequences of breaking residence:

- Shares in private companies

- Qualifying and non-qualifying assets

- Endowment policies, local and foreign

- Payment of provisional tax

Taxation of Non-residents:

- SA rental, interest, REIT dividends and annuities

- Withholding taxes on interest, qualifying annuities and dividends

- Effect of DTA’s, practical application and SARS paperwork

- Disposal of SA immovable property and withholding tax

The index below represents the structure of the Live Event. You will be able to access the information contained within the index once registered. On the day of the event, you will head over to section 2 below where the Live Event will be streamed.

Drag to resize

Meet the instructor

Diane Seccombe

Diane Seccombe is an admitted attorney with a masters degree in taxation. She has over 15 years of experience with taxation. Diane is currently the National Head of Tax Training at Mazars Academy Proprietary Limited and in this capacity provides tax training to professional institutes, banks, financial service providers and financial planners. She is also well known amongst students for her tax lectures at post graduate level. Diane consults on income tax matters including, corporate, individual and international tax and is an expert in Value Added Tax

Live Event series for trainees

Outcomes

- What is Microsoft office 365?

- Introduction to excel and how you will be using excel as a first year trainee accountant.

- Important excel functions you will use daily.

- What is working papers and how does this work in excel?

Live Event series for trainees

Outcomes

The financial statement assertions and audit evidence:

- Understanding the financial statement assertions and their relevance in performing audit procedures.

- Understanding the requirements for sufficient appropriate audit evidence to prove the assertions.

Live Event series for trainees

Outcomes

Ethics masterclass dealing specifically with professional ethics:

- What are professional ethics?

- Why are professional ethics important for you?

- How do you make the right professional choices?

Live Event series for trainees

Outcomes

- Why is Cyber security important.

- What can go wrong?

- Email best practices with reference to cyber security.

- What to look out for, how to evaluate authenticity of emails etc.

- Like farming, phishing, click bait, malware.

Live Event series for trainees

Outcomes

- Why a personal budget is important?

- How to prepare your budget and what tools are available.

- How to use excel for this.

- Top 3 tips in personal finance!

Live Event series for trainees

Outcomes

- Operating within a remote/hybrid work environment internally and with clients.

- What is the change curve and how this relate to your new role as trainee accountant.

- Mastering time management within your new role as trainee accountant - use outlook calendar to your advantage!

- Your health is important – Understand the important of sleep, exercise and brain care.

Live Event series for trainees

Outcomes

- Operating within a remote/hybrid work environment internally and with clients.

- What is the change curve and how this relate to your new role as trainee accountant.

- Mastering time management within your new role as trainee accountant-use outlook calendar to your advantage!

- Your health is important –Understand the importance of sleep, exercise and brain care.

Live Event series for trainees

Outcomes

Risk of material misstatement:

- Understanding what audit risk is, and the three components that affect it.

- Understanding the impact of Risk of Material Misstatement on the nature, timing and extent of substantive audit procedures.

Live Event series for trainees

Outcomes

- In this master class trainees will touch on professional skills directly linked to developing their relational acumen and Winning with People.

- Communication skills, People skills, Relationship-building skills

Live Event series for trainees

Outcomes

- Introduction to Microsoft PowerPoint and Word.

- How to prepare a presentation in PowerPoint.

- How to prepare reports, letters and communications in word in a professional manner.

- .Tips and tricks to be more efficient in Word and PowerPoint.

Live Event series for trainees

Outcomes

Getting the most out of your CA2025 training contract experience:

- Understanding how the CA2025 training programme works.

- Developing the right attitude towards your training contract and the importance of regular reflection during the contract term.

- How assessment works and what to do to ensure that you get signed off at the end of the training contract as proficient.

Live Event series for trainees

Outcomes

- In this master class trainees will touch on professional skills directly linked to developing their relational acumen and managing people.

- Leadership skills, Managing others, Teamwork

Live Event series for trainees

Outcomes

Ethics masterclass dealing specifically with business ethics:

- What are business ethics?

- Why is understanding business ethics important for you?

- How do you evaluate the right business choices?

Live Event series for trainees

Outcomes

- What is emotional intelligence?

- Understand and manage your emotions.

- Understand the emotions of others working with you.

- How to get your emotions to work for you,not against you.

Live Event series for trainees

Outcomes

Developing effective communication skills:

- Understand the importance of effective communication in the workplace (written and verbal).

- Introduction to business writing for first year trainee accountants (including email etiquette).

- How to use Microsoft Outlook and draft professional business emails.

- How to use a translator if English is not your first language.

Live Event series for trainees

Outcomes

Ethics masterclass dealing specifically with personal ethics:

- What are personal ethics?

- Why are personal ethics important for you?

- How do you make the right personal choices?

Live Event series for trainees

Outcomes

Introduction to auditing:

- Why are audits conducted?

- What happens when auditors get it wrong?

- How are audits conducted?

- Where do I fit in this process?

- What is expected of me during the first year?

Dave Loxton

Bio

Dave is currently a partner at Schindlers Attorneys and the CEO of Schindlers Forensics (Pty) LTD.He was previously a partner/ director and head of the forensics departments at several of South Africa’s largest and most prestigious law firms, including ENSAfrica, Werksmans, Bowmans,as well as a brief stint at Dentons, and also spent several years as in-house counsel for one of South Africa’s largest blue-chip listed companies, specialising in employment law and litigation.He started his career as a State (Federal) Prosecutor, and prosecuted the complete range of street crimes, including rape, murder, robbery, drug-dealing, fraud, theft, forgery and uttering, and numerous other crimes. In private practice he has extensive experience in litigation matters, forensic due diligence, prosecution and his focus areas are fraud risk assessment and fraud prevention, ABC compliance, white-collar crime investigations, detection and prevention. He also conducts highly sensitive investigations for the board and chief executive officers of numerous private sector companies and provides regulatory advice and training to the private and public sectors. He is also considered an expert in Cyber Crime as well as Employment Law. David is considered a leader in his field and has been regularly recognised by independent legal directories including the Chambers and Partners Global Guide as well as Best Lawyer.He has been widely and regularly interviewed in the media on fraud, corruption and white-collar crime and cyber-crime and regularly shares his insights at conferences and seminars both inside and outside of South Africa.

Lizette Volkwyn

Bio

Lizette Volkwyn is a master life coach, published author, international keynote speaker, and one of only two certified PEI human lie detectors in South Africa.

She was born in Ladysmith, Kwazulu-Natal, and attended school in Germiston. Unable to attend university due to family circumstances, she started working as an administrative clerk and typist at a bank. Her passion for sales and marketing was sparked when she completed her estate agent diploma and joined the real estate industry, and her stint as realtor was followed by a corporate career in Office Automation and IT spanning more than two decades.

Despite her success, Lizette felt compelled to use her skills and knowledge to uplift others and help them realise their potential. This was the catalyst for the launch of her own consultancy. She embarked on a journey to obtain the necessary qualifications, completing her Master Life Coach course in 2012. This included a masters NLP Practitioner course. She also obtained her Positive Psychology certificate in 2020. In addition, she undertook the rigorous training involved in becoming a human lie detector to better understand her clients and to help them to rapidly achieve their desired results.

Today, in addition to her work as a human lie detector, Lizette offers personal life coaching, sales, leadership and communication training, self-discovery workshops, group coaching, and online marketing training. She has completed more than 25 000 one-on-one coaching hours with clients in more than 20 countries, and authored a book about self-discovery and exploration titled, Finding Me, which has sold more than 2 500 copies.

As a speaker Lizette has presented talks all over the world and has shared the stage with international thought leaders such as Robin Banks, Russell Fox, and Justin Cohen. She is also a regular guest on national radio stations, magazines, and international podcasts.

Lizette is often recognised for her work – in 2018 she was named one of the top three emerging entrepreneurs by Businesswomen of South Africa and was a Margaret Hirsch’s Businesswoman of the Year finalist. This was followed with a nomination for Changemaker SA in 2019, and Extraordinary Changemaker Africa in 2021. In 2021 she received a Business Excellence Award for Coaches and Mentors.

Lizette currently resides in Kempton Park with her husband of 36 years. The couple has three children and five grandchildren.

Dr Jerry Chetty

Bio

Dr Jerry Chetty is a Senior Manager at Santam’s Business Integrity Unit and manages the Forensics, Ethics and Intelligence teams. Jerry has over 20 years investigation experience and knowledge in the detection, prevention, and investigation of insurance crime. Jerry is regarded as a subject matter expert on insurance crime within the short-term insurance sector and has spoken at several conferences both locally and internationally. Jerry is an avid researcher on the topic of insurance crime and believes that research and knowledge sharingare powerful tools for forensic investigators. Jerry is currently redefining investigation methodology and creating the next generation forensic investigator at Santam to incorporate technology as a standard investigation tool.

Qualifications

Jerry has a PhD in Criminology, a LLM, LLB, BIuris, ND: Police Administration, Diploma in Victimology, Certificate in Anti-Money Laundering.

Professional membership

Jerry is:

Qualifications

Jerry has a PhD in Criminology, a LLM, LLB, BIuris, ND: Police Administration, Diploma in Victimology, Certificate in Anti-Money Laundering.

Professional membership

Jerry is:

- An Admitted Advocate of the High Court

- Chairperson of the Institute of Commercial Forensic Practitioners

- Forensic Practitioner (SA)

- Certified Fraud Examine

- Certified Ethics Officer

Annemari Krügel

Bio

Annemari is a Director in the Forensic Services Department at BDO and leads a team that makes a

pivotal contribution through our National Risk Advisory Service to all our business sectors. She

joined BDO in 2018 with the objective to establish a professional forensics team that could serve

the Southern African market. Her team at BDO, with the support of BDO International, provides a

comprehensive, integrated suite of Forensic Services, that specialise in fraud investigations, anticorruption

compliance, forensic technology services and financial reporting disputes.

Prior to her appointment at BDO, Annemari held various senior positions as a director or forensic

consultant.

Annemari started her career in the South African Department of Justice in 1984. By the time she

left the Department to join a Labour Law Practice, she was both an experienced senior prosecutor

and an experienced Magistrate. Her interest in labour related matters graduated to forensic

investigations when she immersed herself in matters where she collaborated with the South African

Police Service. These included several high-profile projects in Gauteng and the North West

Province, on behalf of Local and Provincial Government, that successfully exposed and prosecuted

corruption, fraud, statutory and other related offences where she acted as lead forensic

investigator. Subsequently, she presided over and initiated in a multitude of disciplinary matters on

behalf of the Auditor-General, Teta, Provincial Treasuries in the North West, Limpopo and Gauteng,

Department of Health, Department of Sport and Recreation, City Power and Autopax in cases that

involved the misuse or misappropriation of billions of rands. These positions often included work

associations with preeminent law firms throughout Southern Africa. She is a valued member of the

Executive Team with experience that spans more than forty years in criminal justice, forensic

investigations and prosecutions.

Qualifications

Qualifications

- B. Iuris Labour Law and Human Rights

- M.Phil. Labour and Workplace Law

- Certified Fraud Examiner (CFE)

Advocate Stefanie Fick

Bio

Advocate Stefanie Fick has almost 30 years’ legal experience, most of it with the Department of Justice and the NPA. She worked as a prosecutor for the NPA’s Specialised Commercial Crime Court in JJohannesburg and has extensive experience in the prosecution of commercial crimes such as fraud and money laundering. Advocate Fick joined the Organisation Undoing Tax Abuse (OUTA) in 2017 as head of its legal division. She currently serves as OUTA’s executive director for accountability and governance.

WIlliam (Willie)Andrew Hofmeyr

Bio

Willie Hofmeyr retired in 2019 as one of the 4 Deputy National Directors of Public Prosecutions in the National Prosecuting Authority. He established the Asset Forfeiture Unit in the NPA in 1999 and headed it until August 2015 when he was moved sideways to a meaningless position during the period of state capture. He was reinstated as head of the AFU for 8 months in 2019 until he reached retirement age of 65. During his tenure the AFU grew from just 3 staff members to over 150 and became a formidable force in the fight against crime and corruption, freezing about R15 billion in over 5 200 cases, and forfeiting R5 billion over 4 500 finalised cases. He has served on several international expert groups on asset forfeiture and corruption for the United Nations, Commonwealth and other international bodies. Willie was also Head of the Special Investigating Unit from 2001 to 2011. It grew it from 67 to over 500 staff making a significant impact on corruption. He was removed from the position by then President Zuma in 2011. Prior to this, he was a Member of Parliament for the ANC from 1994 to 1999 where he played an important role in drafting the new Constitution and Bill of Rights, and many of the tough new laws to combat crime and corruption. He left the ANC when he joined the NPA. Before to 1994 he worked as a student actuary and as a human rights lawyer in Cape Town. He was also active in the leadership of the early black trade union movement in the 1970s, and was restricted and banned for 5 years in 1976.During the 1989s he worked for the UDF and ANC and was detained without trial for 2 weeks and later for 7 months. Although he was arrested about 20 times, he has never been convicted of any offence. After 1994 he was elected as a member of Parliament for the ANC and was very involved in the drafting of the new constitution. As a senior member of the Justice Committee he was very involved in the proposing and drafting of many of the anti-crime and corruption laws at the time. . He left Parliament in 1999 to establish the new Asset Forfeiture Unit in the NPA in 1999 and headed it until August 2015 when he was moved sideways to a meaningless position during the period of state capture. He was reinstated as head of the AFU for 8 months in 2019 until he reached retirement age of 65. Under his leadership the AFU grew from just 3 staff members to over 150 and became a formidable force in the fight against crime and corruption, freezing about R15 billion in over 5 200 cases, and forfeiting R5 billion over 4 500 finalised cases. He has served on several international expert groups on asset forfeiture and corruption for the United Nations, Commonwealth and other international bodies. Willie was also Head of the Special Investigating Unit from 2001 to 2011. It grew it from 67 to over 500 staff making a significant impact on corruption. Prior to this, he was a Member of Parliament for the ANC from 1994 to 1999 where he played an important role in drafting the new Constitution and Bill of Rights, and many tough new laws to combat crime and corruption. Willie resigned from the ANC when he joined the NPA. Prior to 1994 he worked as a student actuary and as a human rights lawyer in Cape Town. He was also active in the leadership of the early black trade union movement in the 1970s, and was restricted and banned for 5 years in 1976. Later he worked for the UDF and ANC and was detained without trial for 2 weeks and later for 7 months. Although he was arrested about 20 times, he has never been convicted of any offence. He was released from a 6 months detention in after bring a court challenge that changed the law regarding the rights of prisoners.

Nico Theron

Bio

Nico commenced his legal career, after obtaining his B.Iuris degree at the University of Potchefstroom. In the Criminal Court as a prosecutor and due to his specific skills shortly thereafter developed his prosecutorial career as a specialist in combating commercial crimes. In the SCCU he handled some noteworthy commercial matters reported regularly in the press and law journals, effectively changing the landscape, and more specifically related to the Law of Evidence.

Nico has now been in the private sector for an approximate 20 years and have been actively involved in the investigation and prosecution of matters relating to his expertise, namely commercial crimes, as well as in the securing of recoveries of losses suffered by corporate South Africa. His expertise has, however, evolved into many fields such as sexual harassment/assault, land grabs, robberies, intimidation and business espionage, to name a few. His legal background and prosecutorial experience have furthermore assisted in expediting matters through the criminal process by means of holding watching briefs during prosecutions. He has been outspoken in the protection of corporate South Africa against the onslaught of commercial crime and has a number of articles published in this regard. His commercial mind-set is based on the above foundation and to assist companies in recovery of prejudices suffered due to criminal activities and in the protection of corporate South Africa. He is furthermore a Non-Executive Director to the Board of company employing in excess of five thousand employees. In this regard he assists the Board to ensure that the organization is compliant to legislation and to King IV, with due recognition of the adherent risks associated with continued viability.

Professional memberships

- Affiliate member of ACFE (Association of Certified Fraud Examiners – South African Chapter)

- An accomplished Certified Fraud Examiner.

- Member of IAFCI (International Association of Financial Crime Investigators

Keeran Madhav

Bio

Keeran has over 20 years’ experience in Forensic Investigations, Fraud Risk Management, Dispute Advisory and Anti-Money Laundering. He is a Chartered Accountant, holds a Certificate in Money Laundering Control, an Affiliate member of the Association of Certified Fraud Examiners (ACFE) and a full member of the Institute of Commercial Forensic Practitioners.

Keeran is currently the director at Mazars Forensic Services in Johannesburg responsible for all forensic matters including dispute advisory.

Keeran has successfully performed a number of high profile fraud and/or corruption investigations and has also developed, implemented and monitored Fraud Risk Management Plans/Strategies for clients in the public and private sector.

Keeran is currently the Chairperson of the International Association of Financial Crime Investigators Conference Committee

Keeran is currently the director at Mazars Forensic Services in Johannesburg responsible for all forensic matters including dispute advisory.

Keeran has successfully performed a number of high profile fraud and/or corruption investigations and has also developed, implemented and monitored Fraud Risk Management Plans/Strategies for clients in the public and private sector.

Keeran is currently the Chairperson of the International Association of Financial Crime Investigators Conference Committee

ca2025 tRAINING

EAT On-boarding process

- Demonstration on how to activate the profile on SAICA’s EAT

- Demonstration on how to upload and finalise the training plan which comprises of the Integrated Exposure Plan and Expected Levels of Proficiency (This is based on the assumption that the training plan template is completed correctly by the training office – additional assistance available on request. The additional time investment required where applicable)

- Demonstration on how to onboard trainees via TCMS onto the EAT

- Demonstration on how to allocate a trainee to a training contract and sending the official EAT invitation to the trainee.

- Demonstration on how to add users other than trainees to the platform and how to allocate roles

- Demonstration on how to monitor compliance on the platform.

ON-DEMAND COURSE

Outcomes

- Be aware of what can cause you to not be ethical;

- Understand tools that help you to remain ethical when faced with complex scenarios;

- Gain insight into the process to follow that guides your ethical decision-making.

ca2025 tRAINING

SAICA's Electronic Assessment Tool

- Practical tutorial on how to submit summative assessments/PDSs with specific focus on the role of the trainee and the role of the evaluator and/or assessor. Includes examples as part of the session.

- Demonstration of what the quality of the evidence submitted by the trainee must look like.

Steven Powell

Bio

Steven is a renowned specialist white-collar crime prosecutor and forensics lawyer. Steven specialises in leading forensic investigations that result in successful disciplinary and criminal proceedings against offenders, as well as the recovery of losses in both civil and criminal matters. Steven has been appointed to act for the South African Asset Forfeiture Unit to execute a multitude of restraint and forfeiture orders to recover the proceeds of crime flowing from corporate fraud, and drug and abalone smuggling.

Zakhona Mvelase

Bio

Zakhona Mvelase is a Director Forensic Audit Services at National Treasury she is a seasoned anti-corruption practitioner and has spent over a decade in the field of governance and anti-corruption in South Africa. She is internationally Certified as Fraud Examiner and holds a Master’s degree from Harvard University, she is an awardee of The Harvard South Africa fellowship, which is a fellowship that is awarded to mid-careers who model ethical leadership, knowledge sharing and serve as a resource to improve and transform their communities, she is also an awardee of the John F Kennedy fellowship from Harvard Kennedy School which she received in recognition of her outstanding academic achievement and professional promise with significant distinction.

Ivan Breedt

Bio

Ivan Breedt is the Senior Forensic Consultant, with 29 years of experience, specialising in managing and conducting high level forensic investigations in accordance with required methodologies and standards, within South Africa private and public sectors,including International assignments, on behalf of clients, providing evidence in disciplinary hearings, CCMA, criminal and civil matters.Ivan is accredited with National Diploma in Police Administration – Technikon RSA, and Criminal Prosecution & Forensic Auditing Diploma – RAU. Ivan is the President of International Association Financial Crime Investigators (IAFCI), Gauteng Chapter, South Africa, and a certified member of Institute of Commercial Forensic Practitioners (ICFP).

Stompie (L.A.) Ferreira

Bio

Stompie (L.A.)Ferreira started his Military career in the Intelligence, Surveillance and Counter Surveillance fraternity within the SADF 1983, becoming a Non- Commissioned officer and later an Officer. After completing his training in Kimberley, he spend six(6) years in South west Africa (Now Namibia) where he was in volved in numerous technical, static, and mobile surveillance as well as Intelligence collection (Overt, Covert and clandestine collection)before returning to Military Intelligence Head Office (After1994 renamed to Defence Intelligence)in Pretoria where he spent 6 months at Head Quarters, before being redeployed to the Covert facility of Defence Intelligence. During his tenure as an undercover operative (Later one of two National Team Leaders), Stompie was again involved with different operations on a national basis, including illicit cigarette trade, counterfeit goods, human trafficking, specific operations on the CapeFlats, drug trafficking, as well as the fight against the looters of our natural resources (A project that lasted nine years with an estimated of 60 operatives under his operational response). In March 2001, Stompie left the service and started, Ferlio Group of Investigators and remained as a Private Investigator/National Surveillance Coordinator, with in a National project between the DSO, SAPSCIG, NIA, SARS as well as Foreign Intelligence and police services, managed by the then Scorpions (Directorate for Special Operations) for another five years.

Stompie has been involved in the training of different organizations within SA (Executive Level) as well as that of some SADEC states in especially surveillance/counter surveillance. Stompie’s careers pans over 40 years with his passion being Intelligence/ Corporate information collection (Undercover operations-Saving our clients hundreds of millions), covert camera installations & off-site monitoring, strategic planning, profiling and especially surveillance.

During his career,Stompie received several commendations, including that of the State President for certain operations conducted.

Stompie.

- Completed all required Intelligence, Counter intelligence, Surveillance, Counter Surveillance and Military Lawcourses.

- Studied Business Management with UNISA.

- Obtained a Technical Certification (CumLaude).

- Is a member of IAFCI.

- Is a Certified Fraud Examiner.

- Member of IRMSA.

Dividends, Liquidations and Share buybacks

Transactions between Companies and their shareholder:

Who should attend

-

Distribution of a dividend (including a dividend in specie)

-

Distribution of non-dividends – repayment of contributed tax capital

-

Share buybacks- listed and non-listed companies

-

Liquidation distributions

-

Share dealers vs share investors

-

Deferral of CGT consequences in a profit facilitated sale of shares

-

Conversion of shareholder loans

-

Issue of shares as consideration for assets

-

Corporate Financiers and persons involved in financial planning and advisory services

-

Tax Specialists

-

Practicing Accountants and Lawyers

-

In-house Tax Managers and Advisors

-

Financial Directors, Managers and Business owners

Uncover Business Opportunities using Power BI

Key highlights

- Unveiling the Power of Power BI

- Unlocking Your Hidden Business Opportunities

- Making Better Decisions using Daily Dashboards